Small Data Large Impact

Last few of sessions have been not so good for bulls. We saw straight seven sessions of weakness in Nifty. After reaching near 10500 levels and touching previous high on dollar denominated Nifty we saw this weakness.

The weakness was still more accentuated as the benchmark yield weakened and so did commodities. In this environment one started to have feeling that is there more downside. Are we looking at 9700 again?

The general way of looking at things is to look at the options chain. Undoubtedly it is one of the strongest indicator. However, once in a while all those crucial build ups get breached. Even this time there was decent build up in 10300 – 10500 Put strikes where we witnessed covering of close 50 lakh shares and overall build up reducing down to less than half. With maximum build up at 10200 and little covering, less than 10% of the total build up support seemed to be around the corner.

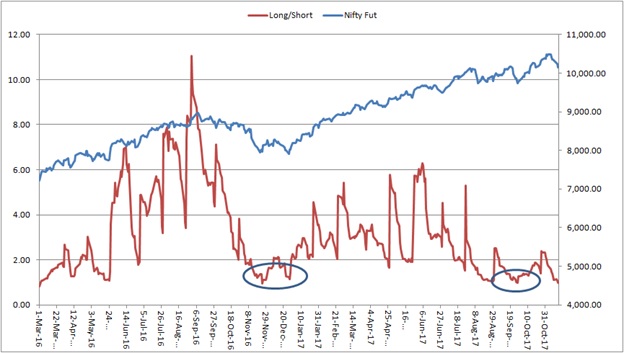

Among the indicators that I see is the FII position in Nifty futures. They are predominantly net long in Nifty. The reasons behind this are many, including arbitrage, directional view and delta hedge. Incidentally, for last few times, Nifty tends to bottom out every time they move from being Net long to Net Short. This time it happened. On Wednesday, net FII Nifty futures position moved to negative from positive. This was a very strong indication for a pullback in offing. Since March 2016 this was third such event, previous two were followed by extremely good upmove.

I picked up Nifty 10200 Calls at ~Inr 80/-. By the end of the trading session, Nifty witnessed a recovery of more than 100 points over previous day’s close, scaling above 10200 levels. The Calls price moved up by ~50% and reached near Inr 120/- levels.

These are all small data points which get lost in the routine noise of the market, but such data points bring few of the best trades.

Happy Trading.

Cheers!!!