Power of Simplicity

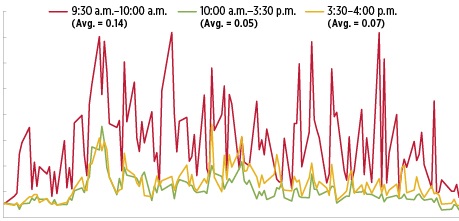

High intraday volatility is the new normal. While Nifty seems largely in a stiff range, the intraday moves have been quite sharp. A 30-50 points move in Nifty in a matter of few minutes is something usual these days. Such intraday moves can hurt trades extensively & makes trading incrementally difficult. Currently volatility rather than being a statistically measure is just a difference between what one expects and what actually happens. A day that starts well suddenly comes crashing down and vice versa.

Interestingly, volatility and interest rates are brothers. When interest rates are low, corporate profits tend to improve and thus, the volatility in terms of earnings comes down and so does the price volatility. As the interest rates move up the corporate earnings have an impact, thus affecting market volatility. In current scenario where interest rates are either increasing or are expected to increase all over the world, high volatility and such choppiness will continue for a while.

In such a situation indicators and positional buildups, become extremely important. They are not to be ignored. Infact, this is the time when one needs to be extremely disciplined in the way they approach their trades. Indiscipline will have a heavy price tag to it. One such, positional indicator is maximum buildups on the options side. With low jazz/glamour built into this indicator, people tend to ignore it these days. Its simplicity is working against it. However, I follow it diligently. During weak markets, the strike with maximum Call build up acts as resistance and during good markets the strike with maximum Put build up acts as support. One can surely adjust weighted premiums to arrive at refined numbers, which can act as stop losses.

Nifty hit near its 200 DMA (near 10150) levels on 7th March and in a matter of 3 sessions recovered back to near 10500 levels. It was a quick ~ 300-point recovery in a matter of 3 days. In such a market it was too quick and too much. Nifty 10500 Call, which had ~54 lakh contracts outstanding, did not see much covering. A 10% – 15% reduction in open interest near those levels is given.

On 13th March Nifty reached near 10500 levels and started coming off. The resistance at 10,500 was playing out. Therefore, I picked up 10400 Puts. A break above 10500 to ~10600 levels would be my stop loss, near the weighted premium adjusted levels. The downside target was again back to 200 DMA. A break below it can be start of fresh weakness but until then that is the downside level. Next two days saw a slow grind but Friday was different, as Nifty lost 165 points in a day. We reached near 200 DMA again. With a weekend in offing, it made little sense for me to hold the position until exact 200 DMA. Hence, I covered my position at a 2.5x gain.

While people continue to look for complex indicators, they forget the fact that simple is not just beautiful but efficient also.

Happy Trading.

Cheers!!