Last week I wrote about how trading can be taught. The areas which needed to be understood are the core understanding of the mechanics and creating one’s own content. The other area was more like soft skills which talks about

A question that I am asked time and again by amateur traders is whether trading can actually be taught or is it a God gift. According to me it is a science and not an art, so it “Can Be

Last week SEBI came out with certain changes in the way derivatives market functions in India. The idea behind it is to bring about more transparency, efficiency, curbing volatility and investor protection. SEBI is the apex body regulating the financial

Money chases growth during good times and safety during bad times. Last decade we have seen all this repeatedly. In 2006-2008 the whole world saw a chase towards growth and post the crisis it was a flight towards safety. Money

I wrote just a few weeks to you about the using simple indicators. That week Nifty witnessed resistance near 10500 and came off. The down move was slow but clear. The idea of resistance at 10500 came from a simple

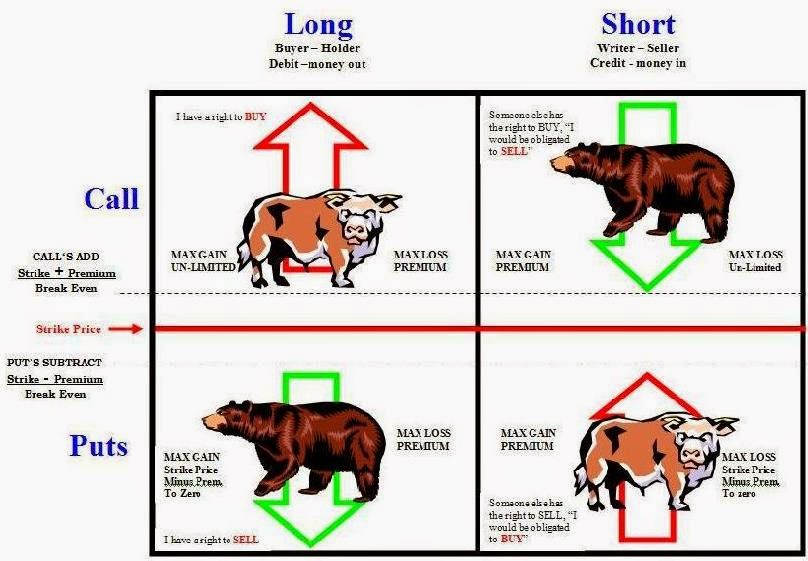

Nifty slipped below 200 DMA and is right at the zone where there is maximum Put build up, 10,000 strike. With ~ 52 lakh shares of open interest, this is by far the largest position among Put strikes. This would

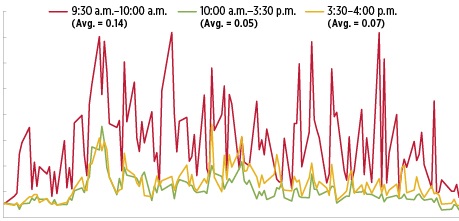

High intraday volatility is the new normal. While Nifty seems largely in a stiff range, the intraday moves have been quite sharp. A 30-50 points move in Nifty in a matter of few minutes is something usual these days. Such

Since budget day till date, markets been a tough for traders, especially the ones who have been bullish. This week Nifty reached near 200 DMA, effectively losing 1000 points from the highs. Nifty Mid Cap and Small Cap index lost

Mutual Funds have been by far the biggest buyers in Indian equity markets for last two years now. With total assets under management at Inr 21.37 trillion of which equity assets at Inr 8.43 trillion and Inr 1.67 trillion in

Multiple theories try to explain the moves in the market. These theories come from various branches of academics, like economics, statistics, physics and at times astronomy as well. All these are so deeply interconnected that it becomes difficult to understand

Last few days have been the most challenging times for a trader. The swings in market and stocks have been extreme. As traders, we all look forward to volatility but such moves can seriously hurt our trades. A very high