On Thursday we ended the July series. It was one of the severest expiry that we have seen in last few months. Inspite of being a month when the government presented its budget proposals, market witnessed serious pressure. The overall

The list of seven wonders of the world has seen changes over so many years that they existed. The original list consisted of Colossus of Rhodes, the Great Pyramid of Giza, the Hanging Garden of Babylon, the lighthouse of Alexandria,

Reform, Perform and Transform

Budget 2019 was presented last week. There have been lot of deliberations around it, whether it was a good, bad or an average budget. But such discussions initially create more heat and less light. It

Quality Prevails

In any form of work, quality is the most important aspect. So, when it comes to stock market, same is applicable. Stock prices in the long run are a reflection of how the businesses are doing. In

Food for Thought

The ICC world cup has started and India has started making its mark. Next few weeks are going to be extremely exciting as match after match gets played. Not very different is with the squad of Team

Things to Know about your Nifty

Few years back when the concept of KYC (Know Your Clients) came in the markets, it was unique. However, slowly this has been well accepted and expanded. The KYC concept not only covers

Too Many Moving Parts (Contd.)

Last week post the exit polls rally I wrote you about too many moving parts in the economy right now. So, while the exit poll results clearly brought a cheer in the markets, worries continue

Too Many Moving Parts

Monday morning on Dalal Street will not fade away easily from our memories. It was the highest single day absolute upmove in the last 10 years. Nifty witnessed a ferocious 3.7% upmove while Mid Cap and

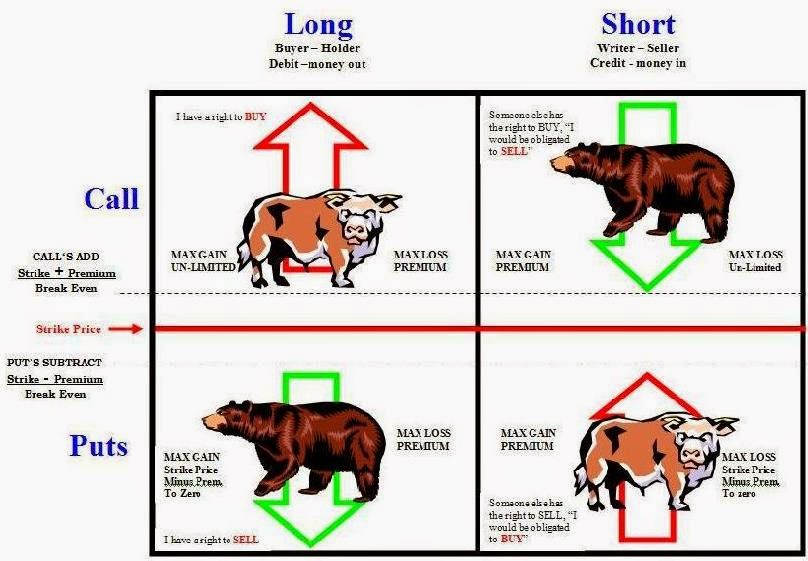

Things you need to know while trading in Options

Consolidation is a very interesting time in any index or stock. Shorter the consolidation, generally, lesser is the volatility post that and vice versa. It’s like the more you press a

Derivatives in India, were launched in June 2000 starting with Nifty Futures. Followed by it were Nifty Options and Stock Options in 2001. However, it was in November 2001 when Stock futures were introduced which changed the game. Indian participants

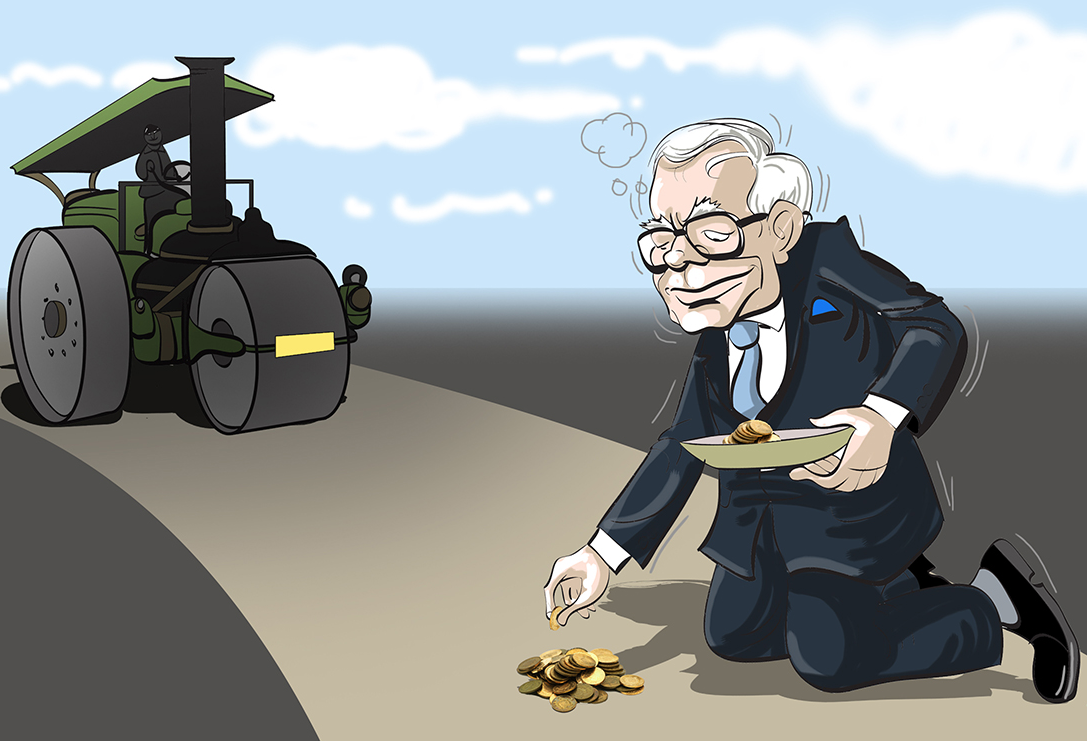

As Indians and specially Mumbaikars we all have experienced bumpy roads. Clearly, over the years infrastructure and roads in India have improved for better, but still bumps are common. Similar are markets and stocks, the moves are never smooth. There

A barbell is a piece of exercise equipment used in weight training, bodybuilding, weightlifting and power lifting, consisting of a long bar with weights attached at end. The bar is empty in the middle and has weights on the extreme

Friday has a special importance in the life for most of us. The mood at that day automatically gets relaxed. Mostly everybody looks forward to the day ending and plans for the weekend. For Mumbaikars, who generally have pretty hectic

Recently, I caught up with an old market acquaintance who was always interested in selling options. Even I have been an options trader for a large part of my career, so we gel well. One reason why writing options is

Last week I wrote about how trading can be taught. The areas which needed to be understood are the core understanding of the mechanics and creating one’s own content. The other area was more like soft skills which talks about

A question that I am asked time and again by amateur traders is whether trading can actually be taught or is it a God gift. According to me it is a science and not an art, so it “Can Be

Last week SEBI came out with certain changes in the way derivatives market functions in India. The idea behind it is to bring about more transparency, efficiency, curbing volatility and investor protection. SEBI is the apex body regulating the financial

Money chases growth during good times and safety during bad times. Last decade we have seen all this repeatedly. In 2006-2008 the whole world saw a chase towards growth and post the crisis it was a flight towards safety. Money

I wrote just a few weeks to you about the using simple indicators. That week Nifty witnessed resistance near 10500 and came off. The down move was slow but clear. The idea of resistance at 10500 came from a simple

Nifty slipped below 200 DMA and is right at the zone where there is maximum Put build up, 10,000 strike. With ~ 52 lakh shares of open interest, this is by far the largest position among Put strikes. This would

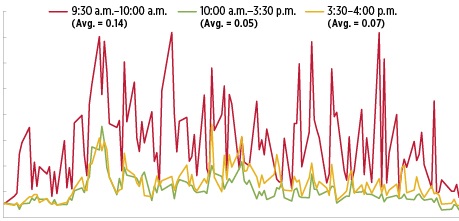

High intraday volatility is the new normal. While Nifty seems largely in a stiff range, the intraday moves have been quite sharp. A 30-50 points move in Nifty in a matter of few minutes is something usual these days. Such

Since budget day till date, markets been a tough for traders, especially the ones who have been bullish. This week Nifty reached near 200 DMA, effectively losing 1000 points from the highs. Nifty Mid Cap and Small Cap index lost

Mutual Funds have been by far the biggest buyers in Indian equity markets for last two years now. With total assets under management at Inr 21.37 trillion of which equity assets at Inr 8.43 trillion and Inr 1.67 trillion in

Multiple theories try to explain the moves in the market. These theories come from various branches of academics, like economics, statistics, physics and at times astronomy as well. All these are so deeply interconnected that it becomes difficult to understand

Last few days have been the most challenging times for a trader. The swings in market and stocks have been extreme. As traders, we all look forward to volatility but such moves can seriously hurt our trades. A very high

This quote was mentioned by Roger Lowenstein in “When Genius Failed”. It is attributed to an external money manager who warned the heads of Long-Term Capital Management about their high-leverage investment strategies. LTCM was founded in 1994 by John W.

The long going debate on LTCG finally came to an end on Thursday, with the Finance Minister declaring the introduction of LTCG at 10% on all equity related instruments. There was some relaxation in the form of 1 lakh of

Option buyers, while they look comfortably placed they are not so always. They are running a tight race against time. So, while a few of the parameters are in their favor, which include Vega and Delta; it’s Theta which looms

Near 11k and no signs of stopping. Undoubtedly markets are treating all the bulls very well. But as the famous quote goes “Everything that goes up; must come down”. With budget around the corner, the threat of this quote coming

Last week we discussed about Option buying and what to look into while buying options. This week we shift our focus to option writing. You can write options against your underlying position, MF exposure or write naked options. Let’s discuss