No Option; But Options!!

Last few days have been the most challenging times for a trader. The swings in market and stocks have been extreme. As traders, we all look forward to volatility but such moves can seriously hurt our trades. A very high level of intraday volatility makes money making difficult. One tends to be whipsawed too many times. Holding positions with deep stop losses and short targets makes risk – reward ratio skewed.

The news flows have been adding fuel to the fire. With the combined view of all exchanges to disallow data sharing with offshore exchanges fresh threat of unwinding and tinkering in MSCI India weight has cropped up. The rout in the banking system got further aggravated after the news about the fraud around PNB erupted. PSU banks, which have been otherwise ailing for a while, got some life post the recapitalization. However, post the quarterly numbers and this news all of those gains have been lost.

Going back to our discussion on intraday volatility, the average intraday Nifty moves during last few months have been in the range of 80 points. This range has more than doubled to 162 points in February. For instance on Thursday afternoon Nifty was well above 10600, which swiftly moved down to near 10400 levels in a matter of 1.5 days. Given such volatility in the market, it typically becomes difficult to trade intraday of for shorter horizons.

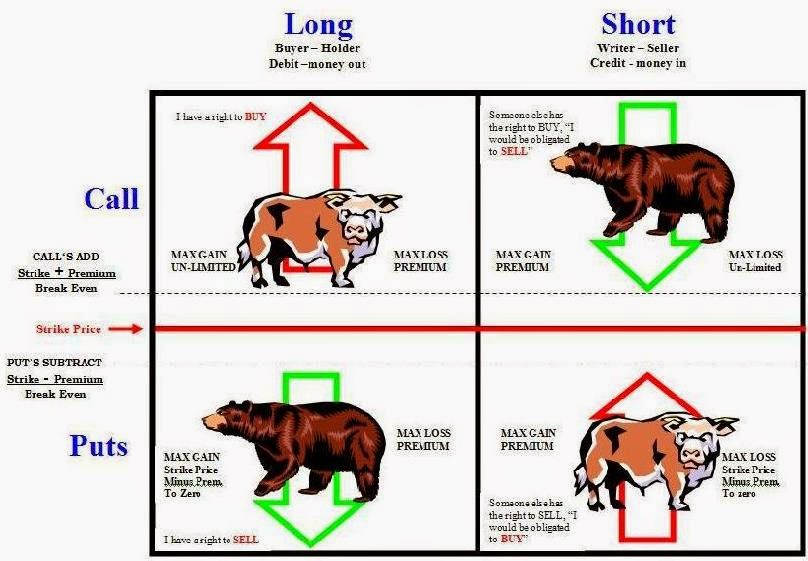

So, if one would have been bullish on Nifty and would have thought of talking a long position using futures on Thursday he would have lost nearly 200 points as compared to 100 points if he had bought at 10600 Call. In addition, he could have bought OTM Calls of 10700 or 10800 strikes and would have ended up losing 45 points or 30 points on them. The other way out would have been initiating spread positions. That would have been equally or probably more effective in preserving capital.

These are times when capital protection in a trade should be of utmost importance. No other instrument provides better capital protection as compared to options. I would like to take this a step ahead and say in the current scenario the comfort in the form of capital protection, risk management and cost rationalization that is provided by options is beyond every form of direct and indirect investment. Many of the mutual funds are also reeling under performance pressure, with balanced funds probably being worst hit post the recent weakness in bond markets.

Therefore, if you are a trader the only options for a well managed (in terms of risk-return) trading is Options.

Happy Trading

Cheers!!!