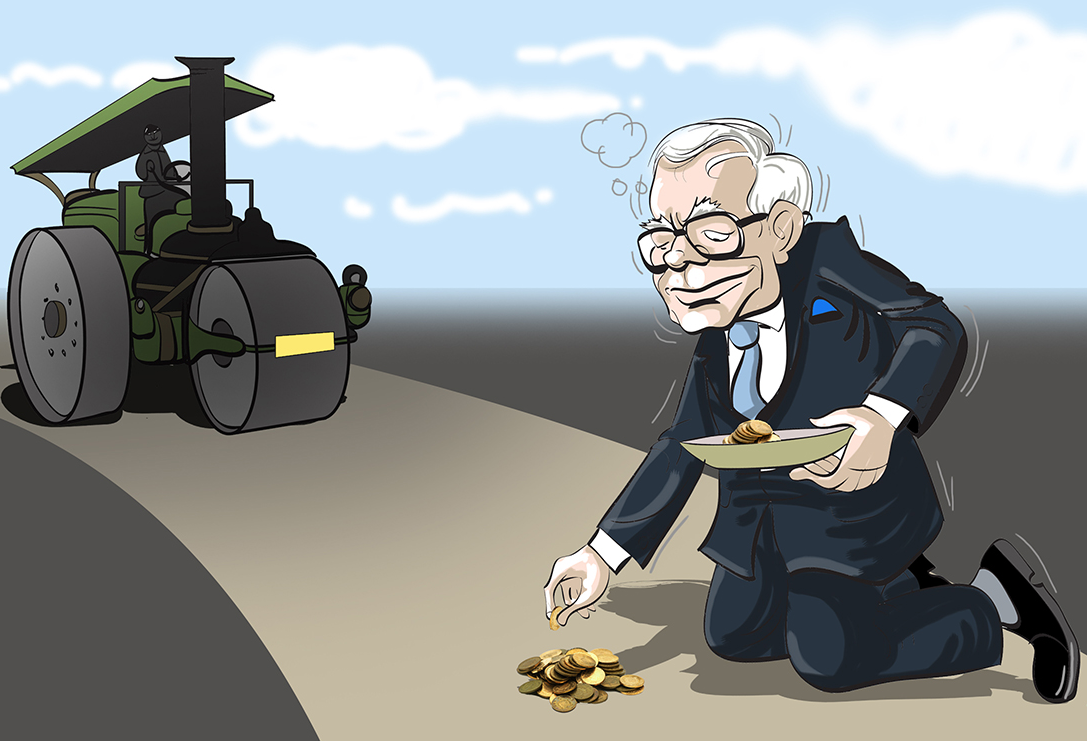

Picking up Nickels in Front of Steamrollers

This quote was mentioned by Roger Lowenstein in “When Genius Failed”. It is attributed to an external money manager who warned the heads of Long-Term Capital Management about their high-leverage investment strategies. LTCM was founded in 1994 by John W. Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers. Members of LTCM’s board of directors included noble laureates Myron S. Scholes and Robert C. Merton, who created the Black – Scholes model for option pricing.

Initially successful with annualized return of over 21% (after fees) in its first year, 43% in the second year and 41% in the third year, in 1998 it lost $4.6 billion in less than four months following the 1997 Asian financial crisis and 1998 Russian financial crisis, requiring financial intervention by the Federal Reserve, with the fund liquidating and dissolving in early 2000. So, obviously anybody can fail in this market.

In recent times the above phrase looks very apt for option writers, who are facing the brunt of extremely high volatility. Low volatility is the best an option writer can expect for his position. Each passing day rewards him for the risk taken by him without being impacted by it.

So, where did all this start from? Since 2016, global markets have been witnessing decent rally. Dow moved up from 16k in January 2016 to 26k recently. This steady upmove took the fear out of the market. The measure of fear VIX (Volatility Index) has been in a range of 9% – 12%. This shifted the volatility trade towards the short side. This is the “the short vol trade” that media is talking about. A short vol (volatility) trade means when there is massive naked option selling. This exposes the seller to huge losses in case of sharp moves in the underlying.

VIX in India is not traded, but globally and specially in US it is a well traded instrument. Not just that, there are many instruments which are created around the VIX in the form of ETFs and ETNs. There are ETFs which can triple short VIX, imagine the kind of leverage building up there. The money invested in these products was approximately $3bn, while ~$2 trillion were invested in various forms of Short Vol trade. When the trade gets cornered on one side it makes a perfect recipe for collapse. For instance, LJM Partners, a Chicago-based hedge fund with about half a billion dollars in assets, collapsed by 82%.

On 5th February, VIX bounced from near 17 levels to 35, highest in last 6 years, pulling down Dow by 1200 points. Since then the markets around the world have caught in a storm of volatility. IVs have shot off the roof. A major risk which this brings is the gap up and gap down risk. Markets open either with a gap and doesn’t give an opportunity to hedge oneself. Currently the volatility is so high; that it’s not market which is determining volatility but it is volatility which is leading the markets.

Volatility always has a spring effect the more it gets suppressed, the higher it bounces. As for all of us, the rout seems to be far from over. With so many events (Mutual Fund consolidation of schemes, impact of LTCG from April 2018 and the newly started issue of SGX Nifty trading to be halted from August) converging in the coming months, volatility seems to be the way forward for 2018. This when one is able to differentiate the men from the boys; the skilled from the unskilled.

Happy Trading.

Cheers!!!