Short Risk Reversal

This week has been slightly different from what the general trend has been for a while. Nifty came off from near 10400 levels to 10100 levels in a matter of 3 days. Nifty had hit 10k in end July but since then we have been around those levels. While Nifty scaled near 10.5k it has been finding lot of difficulty in sustaining higher levels.

While Nifty has been range bound and has not been the best of the performer as compared to rest of the peers, still there is a strong feeling of bullishness. Probably it is lead by the upmove in mid cap and small cap names. Undoubtedly, such things keep the overall market mood upbeat.

As we entered the expiry week, I realized that the data and the events are not really in favor of an upmove. Just to list them quickly:

- The Nifty futures position was quite heavy and so were stock futures position. This would bring pressure during expiry week.

- FII continue to be on the selling side.

- Large deals continue to suck liquidity from DIIs.

- Monetary Policy to be declared in early December, where, market fears a rate hike or a possible hawkish stance.

- Gujarat state elections will be during mid of December and media reports are talking about tough times for BJP.

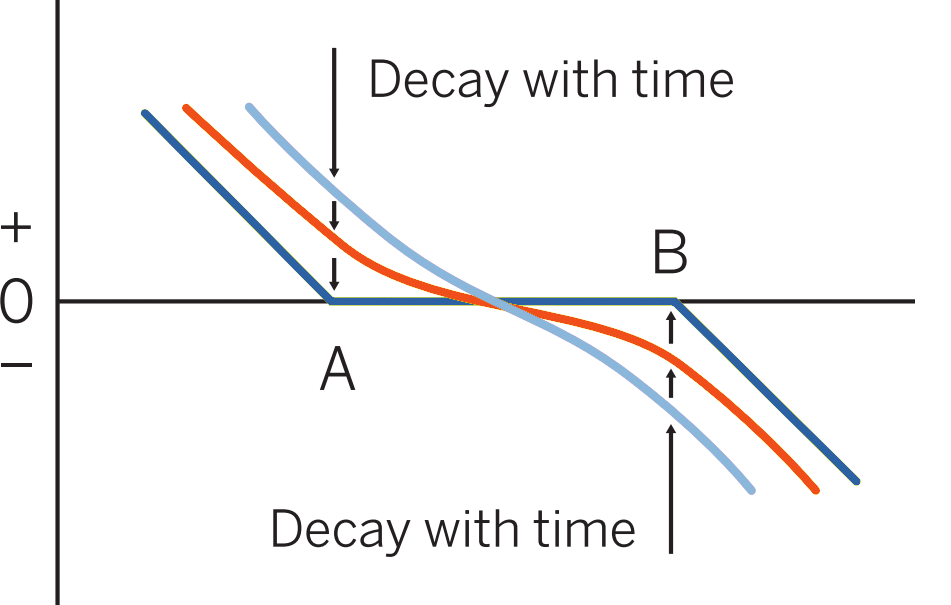

So, with this in mind, it seemed that a large upmove on the upside immediately seemed to be difficult. With that in mind, I decided to create a Short position. I am a generally an option buyer, so I started with Long Nifty December 10300 Put at Inr 80/- on Tuesday. However, this time I played it little differently. I created a synthetic short by selling Nifty December 10600 Call at Inr 68/- as well. Technically, this is called a Shot Risk Reversal strategy. Net – net I had a Short position with 10300 -10600 as no impact zone, sharp gain below 10300 and loss on a break above 10600. The cost of the strategy was just Inr 12/-.

As the expiry week took off Nifty continued to reel under pressure. The expiry day as expected was seriously bad. Nifty lost close to 130 points. The spread was now worth Inr 114/-. A clear 10X on my position in a matter of two days. It was seriously fast and furious. During the VWAP on the expiry day, the pressure was tremendous. It seemed that the pressure should go on beyond the expiry day. Undoubtedly the lure to close the position was immense and so was the gain. However, I decided to hold on with a view that I will cut my position if Nifty goes back above 10300 levels.

Generally, market tends to reverse the move of VWAP hour in early trade of next day. Well, that’s what happened; Nifty started off well but soon gave in. Post Europe open the fall accentuated as Nifty lost another 100 points. With 10000 as crucial support zone there was no point to hold on to position further.

So, on Friday by day end I covered my position at Inr 200/-. Typical bull market corrections are sharp and fast and that’s what happened this time.

Happy Trading.

Cheers!!!